Balance Sheet Reconciliation Software for Accurate Financial Close

Achieve 90% Automated Reconciliation with AI Agents

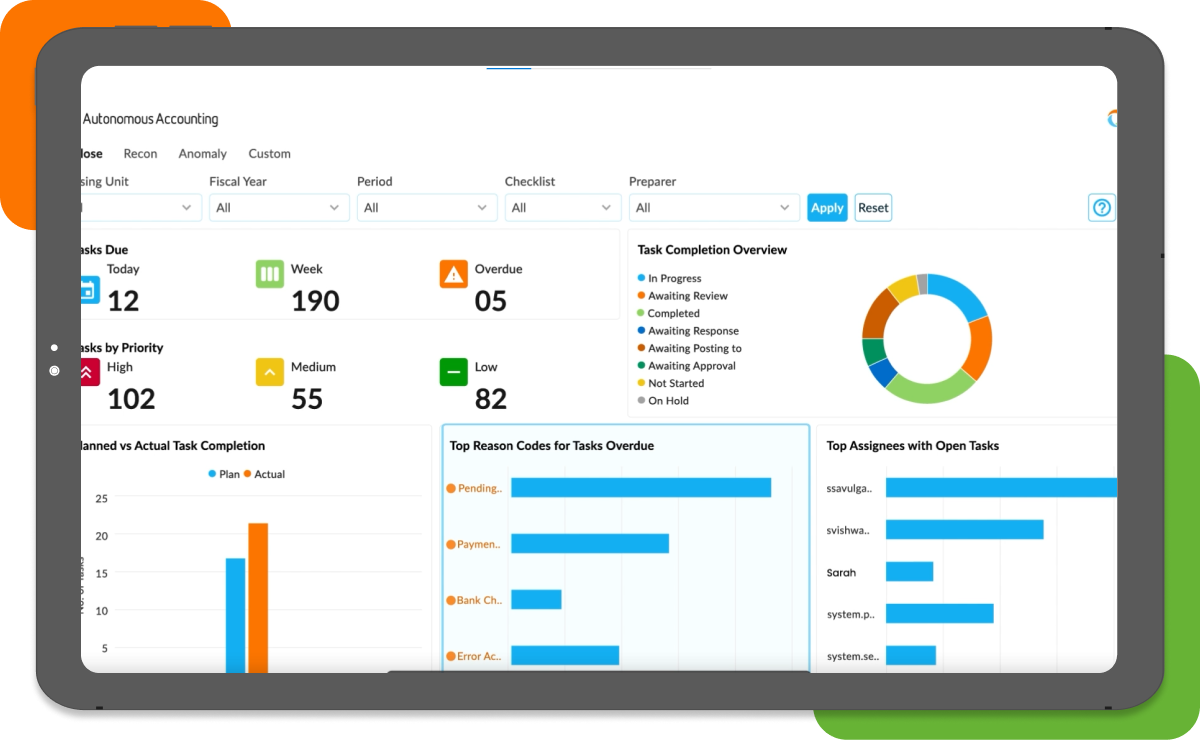

- Automate reconciliations with intelligent discrepancy detection and AI-driven matching.

- Improve accuracy using rule-based workflows and real-time data validation.

- Ensure compliance with secure audit trails and audit-ready reports

Trusted by 1000+ Global Businesses

Reconcile with 99% Accuracy with AI

Just complete the form below